Are you looking to figure out more about your credit score? You probably already know that in the modern world, big business keeps up with your comings and goings in the area of credit. Your credit score is being monitored. Also, most of the things you buy are being kept up with, for the simple reason that businesses want to see where you spend your money.

As time goes on, the way each of us spends money is used to create a credit score. Everybody who spends money on credit has one. This score follows you around all the time, and it can have a big impact on what you’re able to buy or borrow. The number is three digits long, and it sums up the “health” of your credit easily, so everyone who thinks of lending to you can check it. This score makes a big difference in what you can do with your money, or what you can borrow.

So, you may be wondering by now: Who is keeping up with all of these numbers? If everyone has one, then surely someone behind the scenes has to be keeping the data current. There are, in short, three main credit reporting services, and they are called Experian, TransUnion, and Equifax. These three companies keep up with credit scores for everyone with credit, so get familiar with them.

These companies make their money by selling your info to banks and other businesses. Even potential employers can get info on you from them. They sell data and info about you, such as your credit score, your credit history, and any information related to how you buy and spend money. They know how you spend, all about your debt, and your places of employment and residence. If you’ve ever been arrested, or filed bankruptcy, or been sued, they know about it.

This information that these three major players have is put together to score you on your use of credit; they’re pretty much grading you on your ability to be financially reliable. If you have a high score, that’s the best you can hope for. The different credit bureaus, as they’re called, come up with their own scores, and they each reflect a certain set of criteria applied to a formula. At the end of it all, a company called FICO comes up with the single score.

Even if you say you’ll never owe money again, something that’s not a bad policy by any means, your credit score still affects you immensely. There are a lot of times when your credit score will be used, and there are important things you can do with a high score: buy a house, rent a place to live, buy a car, or buy insurance. And if you’re looking for work, many companies will look at your credit score then, too. It makes you seem more dependable if it’s higher.

The most popular score, which is the FICO, has a range of 300 to 850. If you have a score of 700 or higher, that’s the best you can do, and is highly favorable. If you have 640 or lower, your credit is poor. From 641-680 is fair. From 681-720 is good. And from 720-850 is excellent. You can borrow differently with higher scores than with lower, which may put you at risk for higher-interest loans, which can be troublesome. You’ll want to keep your score as high as you can.

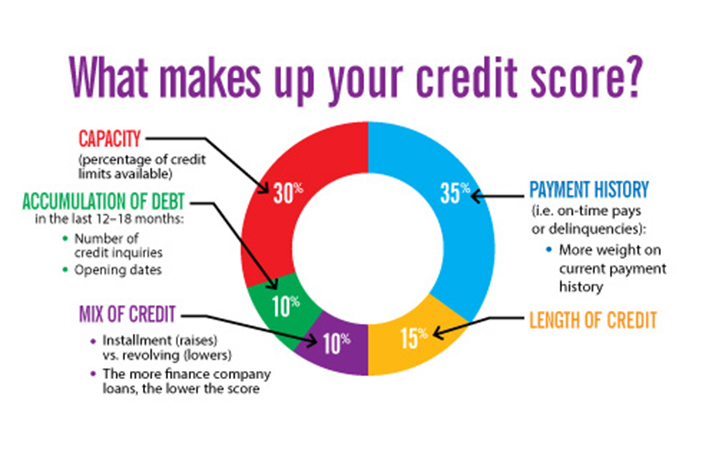

Some reasons that your score might change are simple. Much of your score is based on your credit history. If you pay back your loans and debts on time, then that counts for 35% of your FICO score. If you make just one late payment, this can affect your score for up to seven years. If you have any bankruptcies, collections, foreclosures, or lawsuits, these will be measured here, and will affect your score greatly.

If you owe a lot of money, this can affect your score also. If you use a lot of the credit you have, this can lower your FICO score. This aspect of your score counts for 30% of the total. It’s best not to use all the credit you have available, and you should, of course, always try to pay off your debt as quickly as you can. But, in the real world, we know that these things are a bit more complicated than they might seem at first glance.

If you have a longer credit history, this counts for 15% of your FICO score, and it can make a big difference. So, hang on to your credit for as long as you can.

The types of credit you have matter, too. This does indeed count for 10% of your FICO score. If you have a mix of credit on your account, then you’ll fare better.

New credit counts for 10% of your score. If you open a lot of accounts at once, then you’ll end up with a lower score. Pace yourself, always.

So, maybe you want to know how to make your score better. Of course you do. You’ll always, first of all, want to begin early, and open up an account of some kind. You can start with a regular credit card or a line of credit. If you can’t go secured, try going unsecured.

Don’t use your cards too much, secondly. If you have a high limit, use about one-half of it. Don’t max out your cards, if you can help it, and be sure you don’t go over. Always spend less than your limits allow.

Pay on time. Make sure you pay your bills when you’re supposed to, and if you end up paying off your cards, great! But keep them open; this shows that you can be prudent with cards by not overusing them.

As you can see, having good credit is everything! So be sure that you keep the faith, use your cards wisely, and don’t pay late. Be sure, too, that you request a credit score from myfico.com to see the whole picture. We know you’ll do the right thing.